P-Delta and the Force Continuum

We’re taught to respond to exogenous events using a set of balanced, progressively more acute responses. Police officers are trained in the use of “Force Continuum”, progressing from presence and verbal warnings all the way to deadly use of force. One of the major problems facing peacekeepers in past decades has been an obscure set of Rules of Engagement, often cooked up in political backrooms by men that have never done 20 consecutive pushups. Even in a fully declared war, political gerrymandering around the rules of combat cost lives and nations.

It’s easy to understand why politicians are compelled to act incrementally to emerging events. Winning the popularity contest and the spin game of politics requires a careful read of your audience. Perception is reality. Often at the detriment of outcomes. Imagine some set of Use of Force Continuums for any imaginable event that a leader has to face. They will all look different. Each step comes with a cost. In the policing example, the cost of making an arrest is higher than the cost of presence and lower than the cost of drawing and firing a pistol.

Many times, if you choose the appropriate level of force on the continuum, you will be accused of overplaying your hand. The incremental cost can become the straw man your opponents decide to burn. This sort of post hoc analysis is often understood to be disingenuous in politics. Just part of the game in a full-contact sport. Now scale this down to the coach who decides to bench his player that passed the concussion protocol, but looked ‘off’ in warmups. If the team loses without the star cornerback, fingers are pointed (at least in this case). This outcomes-based analysis only serves to reinforce the faulty process. What happens the next time there is a borderline injury situation?

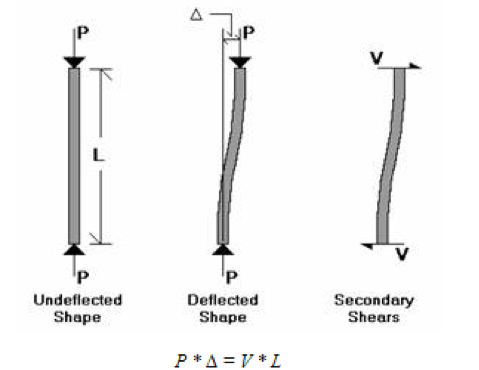

And then you have the problem of first and second-order analysis. Engineers talk about the perils of first-order analysis that doesn’t consider the deformed shape of a structure. This has to do with understanding the network effects applied by first-order effects. Engineers talk about something called P-Delta analysis, where P represents the force acting on the body (say a support beam) and delta refers to lateral displacement. P-Delta destabilizes the beam through non-linear, non-first order sets of cascading mechanisms.

A load on the deflected shape will catalyze second-order effects like shearing and volatile moments of inertia. This generates positive reflexivity reinforcing weakening in the structure. Metallurgical effects from shearing over time will reinforce the deflected shape and increase the lateral deflection, and so on.

Let’s think about the combination of the two concepts above. Combining a poorly calibrated Use of Force Continuum with ignorance of second-order effects only amplifies the potential for positive reflexivity and system collapse.

This is how things fall apart. Consider the response of the Singapore government to CV-19 compared to that of the U.S. Yikes. Want to take this a step further? Look at what the U.K. is doing with their most likely disastrous policy based on the dubious concept of ‘herd immunity’. I’m Canadian and am disgusted by the lack of leadership from Ottawa so far. Far too slow a progression through the Force Continuum. We’re still allowing flights from Europe. Screening at airports from inbound international flights is not happening. Canadian PM Trudeau’s wife has contracted CV-19. This still hasn’t been enough to wake up legislators. The most pertinent second-order effect of this failure of policy escalation could be the structural collapse of the support beams, in this case, the health care network. If the lateral deflection weakens the support beams enough, the whole building falls down. Once the health care system falls, everyone is on their own. This also describes the U.S. situation. However, we’re seeing steps in the right direction recently from the White House, and hopefully, mobilization is hard and fast.

There is a high cost to social distancing, travel bans, event and school closures. Those most at risk to the economic ramifications are wage earners that are employed at hair salons, restaurants, stores, bars, and entertainment venues. Many are already in precarious economic straits. Addressing this is another component of the Continuum. Providing these people with some sort of economic assurance, be it through debt repayment holidays, helicopter money or accelerated unemployment benefits (I’m not going to analyze what’s best here as it’s over my pay grade) needs to happen immediately.

The same poorly calibrated Continuum and ignorance of second-order effects is being mirrored by the financial community for the most part. The traditional investment advisor and their big bank employer still don’t get it. Their Continuum doesn’t include an option that says “sell everything and go to cash”. This is an asset-gathering business after all, and it’s impossible to charge 1% on a fee-based account when clients are 40% or 80% in cash. The ignorance of second-order effects at the client-advisor level is glaring. What will happen to their business if most clients lose 50% of their capital over a 12-month period? Won’t happen they say. Why? Because our bank economists and strategists say stocks are cheap and GDP will only go down for a quarter or two. (LOL). I just read CIBC’s economist Avery Shenfeld’s Sunday afternoon blast. Check out this gem:

“Overall, we see 2020 global growth at 2.7%, versus a prior forecast of 2.9%. Owing to recent disappointments, we knocked down 2020 eurozone growth to 0.7% (from 0.9%), and also set our sights slight lower for the UK (to 0.6%). “

Are you out of your mind? But par for the course. We’re not just dealing with the ignorance of second-order effects here of course. We’ve got conflicts of interest and shitty-to-the-point-of-dangerous linear econometric models that have never been able to call growth and cycle inflections. All this exists within the larger zeitgeist which Eric Weinstein calls the EGO – the Embedded Growth Obligation – that permeates every major corporation, central bank, and economy in the world.

Direct response failures directly to CV-19 entirely ignore the asymmetry between Type 1 and Type 2 errors.

Read this from Josh Wolfe’s recent letter to Lux L.P.s:

“Make no mistake: those who calmly waited and reflected while others panicked in our ancestral environment were eaten by tigers.”

The cost of one of our ancestors standing up and looking around when they hear what might be a tiger in the savannah is minuscule compared to the potential cost of not standing up and potentially being eaten. We’re talking a handful of calories. Just another notch down the Continuum. A pure asymmetry of potential outcomes.

We’re going to beat this thing. Hopefully, policymakers get their respective acts together and we come out the other end of this in decent shape. As a society.

But I believe the second-order effects in both global economies and social behaviours are being nearly entirely ignored.

These comments from excellent Natixis economist Trinh Nguyen resonate loudly with me:

Of course, economists are out to lunch on their 2020 forecasts for a multitude of reasons. Ignorance of path dependency, second order effects, and the institutional embrace of EGO, just to name a few.

But what if the experience of CV-19 changes the way that society at large thinks about the things that are important to them? If your health fails, it really doesn’t matter how many nice restaurants you visited in the last year. Do I need 2 gym memberships when I have a Peloton and some dumb-bells in the basement? Do I even need the Peloton since I barely use it and that monthly fee can be chopped?

I am talking about the potential for a recalibration of the relationship people have with their preconceived notions of value. Do you value having an 18-month cash reserve more or less than before CV-19? Will the perceived value proposition of going on a cruise revert to pre-virus levels? Yes then No. This is entirely at odds with the EGO. We’re nudged daily into participating in an ecosystem that perpetuates unnecessary consumption and untethered complacency.

Some market commentators have written on the pulling forward of demand through monetary measures since the GFC. Sure. But what about the nascent extrapolation of social behaviours and the implications on broader society (which includes markets)?

Path dependency and all that.