How Fireworks are Made (Not Always in China)

Markets this past week were rattled by some outsized internal moves, particularly across sectors that had posted momentous gains from the March lows. Let’s look at the micro-tech wreck of late last week from a broader context.

The outperformance of growth vs value factors (yellow) has reached extreme levels. This is happening right as the trade-weighted USD (green) tests long-term (10 year) support levels.

A DXY level under 94 for a meaningful period (weeks) could confirm a break in the trend going back to 2011. But a bounce from long-term support likely sets up more mayhem in equity return factors.

Below is the S&P Value Index ratioed to the NASDAQ. For years now tech and growth-weighted indices have dramatically outperformed value. The period leading up to the tech bubble peak in 1999 was explosive – and then as the TMT bubble popped, value out-performed wildly ‘right of bang’.

Portfolios mostly purely representing these factors (from Russell 3000 constituents) are posting returns that are – something else. It’s quite unbelievable actually (look at YTD returns below).

The other week I wrote about TIPS, gold, inflation expectations, and rates. The case I made was that using long-term monetary base terms, gold is not historically overvalued. But over the shorter term, deviations in the relationship come from changes in real interest rates.

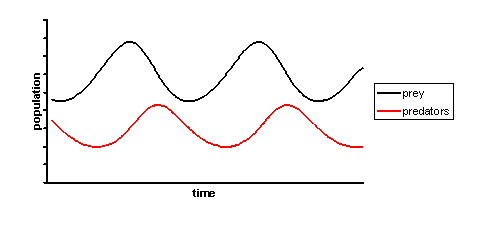

Bill Gross wrote an “Investment Outlook’ letter recently that made the case for lower real interest rates (“r”) significantly influencing the price (“P”) of growth (“g”) stocks more than for value stocks based on the Gordon dividend discount model (DDM). He’s trying to explain the outperformance in growth in the context of the DDM.

If you remember this formula from finance 101, it means that price equals current dividends dividend by “required rate of return” minus “expected growth rate of future dividends”. Of course, this is just one of a myriad of old school equity valuation methods.

He argues that if you use real rates for r, and they go down, but growth isn’t adjusted lower because we’re talking about a ‘secular grower’ (Amazon), the discounting of future dividends will lead to dramatically higher valuations. Further, he notes that the price of MSFT carries a -.85 R-squared to TIPS yields. I can’t actually get to these correlations (but below I show what I think he is getting at). Focusing entirely on growth/value equity style spreads blowing out as a result of simply the Gordon DDM seems a little spurious to me.

But here’s what we do know:

1) Of late, real rates and the outperformance of the growth factor have been very correlated. But it’s much muddier on a longer-term basis.

The thick orange line represents real 10-year rates, and the lighter orange line is Value factor performance / Growth factor performance. I think this is what the former Bond King was getting at.

But, if you zoom out a bit further, real rates bounce around while value continues to get beat up.

2) The largest holdings of growth factor proxies (indices, ETFs) are over-represented by companies that either benefitted from Covid (e-commerce) or at least were highly insulated from shutdowns.

The $55 Billion market cap IWF (iShares Russell 1000 Growth) top 5 holdings are AAPL, MSFT, AMZN, FB, and GOOG. Those 5 represent almost 40% of the fund’s holdings. Other growth proxies carry similar weightings.

Now we have crowding among growth index constituents, and then further crowding into the growth factor (and products) by institutions, and more recently, retail.

The pendulum has been pushed to extremes by crowding squared – both in the sense of what growth proxies are concentrated into and by how investors have concentrated into growth factors. This of course had started long before Covid emerged.

The emergence of a global pandemic created an exogenous catalyst to push the pendulum even further. At some point, the pendulum falls or breaks. Are we there? Signs are indicating we could be close.

3) Bond yields have also been pushed to extreme levels, but not necessarily by direct CB intervention

30-year Treasuries yielding 1.23% is a shocking level in absolute terms. But the rate of change in yields since February has been unprecedented.

In absolute terms, the early-mid ‘80’s experience demonstrated more extreme moves in 30-year yields as Volcker set about on his inflation crushing policies.

But on a lognormal basis, the 2020 experience in rate of change terms takes the cake.

The implications for long-term liability matching and income are obvious. Pensions and endowments are pushed into other asset classes to generate returns. Gone are the days of sterilizing long-term liabilities at a 3-5% notional return.

The S&P has traditionally been one of many recipients of massive global carry trades. With dividend yields on most index components exceeding that of Treasuries, this carry trade has exploded in notional terms.

Meanwhile, the S&P earnings yield sits at just 4.25%, well below its 10-year average of 5.7% and at its lowest level since 2009.

This is a trailing yield measure. On a forward basis, the S&P earnings yield is just 3.93%. After parsing SPX forward earnings estimates, it’s fair to say that the street is pricing in some genuinely optimistic scenarios.

Last week I highlighted the runup in TIPS implied inflation, despite bond yields grinding lower. Significantly negative real rates have led to substantial moves in gold and silver.

Below is a bar graph from a recent JP Morgan slide deck:

Equity indices certainly aren’t pricing a recession, are they? Aren’t we already in a recession? Do models like this have any value anymore if CBs maintain their narratives of omnipotency?

There has been no shortage of Treasury demand, though supply has skyrocketed. In fact, the Fed has bought almost zero Treasury Bills, though the government has issued about $2.2 trillion in bills to raise cash for economic stimulus amid the pandemic. Remember that massive TGA balance I discussed a couple of weeks ago?

Bond strategist extraordinaire Jeffrey Snider wrote a fantastic piece; So Long As The Bucket Is Full of Holes, Treasury Demand Comes First that convincingly challenges the concept that the Fed is directly responsible for the current yield environment.

His main point is that debt monetization isn’t usually inflationary on its own. And that there currently is an unquenchable demand for the safest, most liquid assets in the world (USTs). The majority of Treasury purchases are predicated on real demand. He makes a strong case that recent pickup in inflation is not a result of CB purchases, though they would have you believe that.

If Snider is right, then we should be thinking hard about the alternate stories being told by equities compared to bond markets. The admirable track record of the bond market should make you question expectations embedded in growth stocks from these levels.

This is another sign that the bungee cords tying together equity style factors may be near their elasticity threshold.

4) The derivatives market has turbocharged spread widening across equity factors.

Last week Goldman Sachs noted that single stock volumes have reached 114% of share volumes. The options market is now larger than the shares market. What used to be the tail that sometimes wagged the dog has morphed into the wolf that shakes the dog.

They also note that single stock option volumes with less than 2 weeks to maturity now comprise 75% of total options volume. And this is particularly weighted towards calls.

What stocks are fueling the historic surge in options volumes?

Growth and tech. And retail-driven orders (<50 contracts) are the major driver.

Option upside skew is also inverted on a large number of popular growth stocks: AMZN, NFLX, TWTR, AMD (quite the recent move on that one).

This type of speculative positioning is so far responsible for significant intraday volatility in popular growth names like TSLA and AAPL.

Dollar King Now a Paper Bag Princess?

Since the Dollar was the first major macro component discussed in this note, let’s address the de-dollarization narrative. These types of stories find boosted transmission power post hoc periods of dollar weakness. “The Chinese are done with the Dollar (via USTs) for good this time!”

Is it all happening right now, with the USD on long-term trend support?

Recall that the China de-dollarization story was predominant in 2014, right as PBoC holdings of UST’s stopped growing.

In late 2016, China sold an enormous number of USTs (much of them through Belgium). In the 2015-2018 period, the world went through 2 offshore Dollar shortage (Eurodollar) events. Central banks scrambled, and in the case of the PBoC, they widened the Yuan trading band and sold Treasuries.

Here’s Snider on the topic:

“In between (2015 – Feb 2016), as Reflation #3 took hold, suddenly the Chinese weren’t interested in de-dollarizing any longer? The level of external debt, almost all of which denominated in the dollar, rose like CNY under globally synchronized growth; not because of the PBOC’s dollar activities one way or the other, but because of that reflationary substance centered on 2017…

So, going back to 2011 and Euro$ #2, every time there’s a renewed dollar shortage the media gets filled with stories about China de-dollarizing. Back in 2011 it was all about bilateral currency and trade deals which were sure to finish off King Dollar’s remarkable if too lengthy reign.

Once you take the central banks out of the equation, you have no such trouble understanding these ups and downs. Not purposefully de-dollarizing only occasionally, being forcefully, painfully, involuntarily de-dollared if intermittently.”

(His full piece on this is here)

The prevalence of these ideas can inflect sharply when it seems like a U.S.-China Cold War Train is picking up steam. And it probably is. But the same argument has been made for almost a decade and has proven secular dollar bears wrong time and again.

Here’s the point: whether or not the trade-weighted Dollar holds long-term support levels here likely has nothing to do with a de-dollarization narrative. In fact, the USD is grossly oversold, and history suggests that this is likely not “the big one” – the singular event of global (primarily Chinese) de-dollarization. De-dollarization is a process, not an event.

Consensus remains firmly Dollar bearish. CFTC USD non-commercial positioning is at extreme levels, equalling lows from 2014 and 2018, periods from which the Dollar rallied sharply. The one-year CFTC positioning Z score is just shy of 2.0.

1+2+3+4 = ?

The 4 points taken together paint a picture for extremely crowded exposures and the potential for future fireworks. Not necessarily for a market crash, a bond rout, or a financial crisis. But instead, the potential for huge factor reversals and drawdowns in crowded risk assets. This would have implications for overall equities, growth/value, and even gold (on which I continue to take a bullish view, though caution is warranted here from overbought levels). 5-year real rates reverting back to just -1% (from 1.36% currently) would imply mid $1,700 gold – down about $200 from Friday’s close (which would probably be a buying opportunity). We were just there a month ago. Probably time to at least partially ring the register.

Interestingly, a compressed set of events – stimulus rollovers, the forbearance cliff, and the final push to the November election – are all right in front of us. If we get fireworks, the talking heads will ascribe them to various real-world events, ignoring the path that got us here and current overextended positioning. The elastic bands holding together the machinery are stretched precipitously, and something will have to give.

The powder keg is primed. What we saw starting on Thursday’s massive reversal of growth (tech, NASDAQ) and into value (staples, energy, utes) is getting a fair bit of attention, though has been minor in the context of the YTD factor returns.

It’s certainly not encouraging for the broader economy that decreases in U.S. Weekly Initial Claims has stalled out around 1.4 mm, particularly when combined with the U.S. and the world still make record daily number of Covid cases.

Going forward, no one knows what happens in real-world terms: jobs, the virus, the election. In market terms, very small reversions from extreme levels of asset positioning are creating some minor doses of mayhem (ahem, TSLA and AAPL longs).

These kinds of reversions normally take longer to play out than expected. In many ways they already have. The short-term pain trade could be dollar down, and growth equities to new highs before the fun begins, twisting the knife in the remaining dollar bulls and value-weighted investors. But this is 2020 after all. We may not be there, but a lot of signs indicate we are close.